Editor’s Note: This is the first of three articles by insurance industry expert Kevin Cunningham addressing the malady of rapidly rising insurance costs in the crane and heavy-haul industries. Look for the upcoming stories in the October and November editions of Crane Hot Line.

Today, crane insurance costs are rising, driven by record-breaking nuclear verdicts and Third-Party Litigation Funding (TPLF).

These two factors are prevalent today in all industry segments, but especially in high-hazard businesses.

In recent years, nuclear verdicts have grown in size, scope and frequency, mainly because when an accident happens, private equity companies and plaintiffs’ lawyers are more often using TPLF.

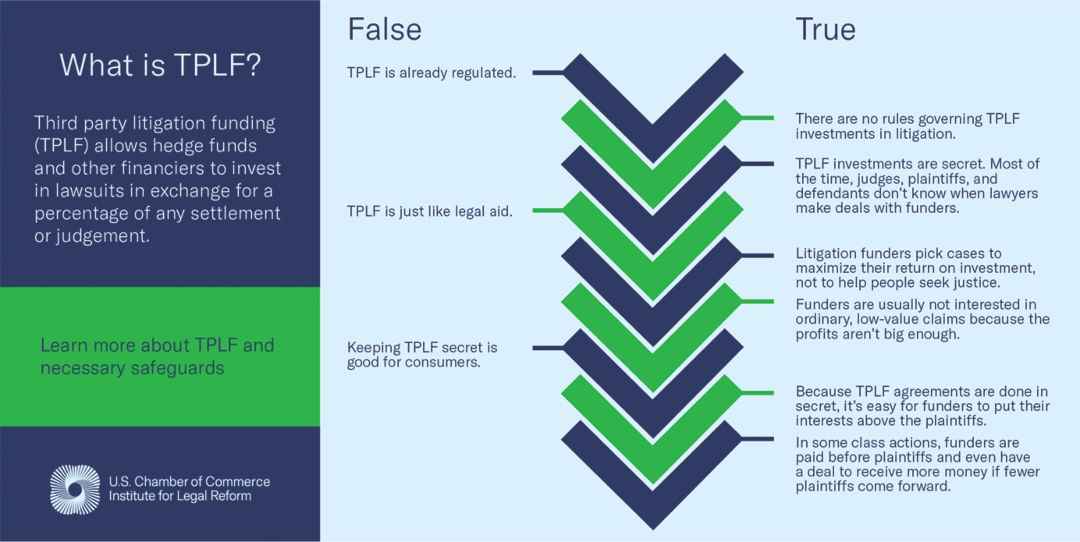

For readers not familiar with the insurance business or legal profession, TPLF involves a deep-pocket investor, such as a private-equity company, investing money so attorneys can mount a well-funded case on behalf of a plaintiff in order to win an exorbitant amount of money that everyone can split.

TPLF does not aim to get a fair settlement for an injured plaintiff; it looks to win a lot of money for the attorneys and the investors.

The insurance industry (insurers and reinsurance companies) pays the price for these unfairly large verdicts, which hurt not only the overall insurance industry but also the companies it insures, for example crane owners.

The result is that all insurance buyers are feeling the pain of rising costs, and crane company owners are feeling the brunt, due in large part to the potential high severity exposure inherent in crane operations.

Crane owners need to understand how and why nuclear verdicts can arise, and what they can do to curb crane accident exposure in order to avoid growing claim litigation.

Drivers of Nuclear Verdicts

According to the U.S. Chamber of Commerce Institute for Legal Reform, nuclear verdicts are fueled by many direct and indirect factors.

In the courtroom, plaintiffs’ lawyers often use tactics that manipulate jurors to arbitrarily inflate damages.

For example, they resort to “Reptile Theory” tactics to make jurors feel fear or danger so that they will lash out at their perceived attackers (the defendants) by awarding a plaintiff inflated damages.

Additionally, in the courtroom, plaintiffs’ attorneys often suggest that the jury award an exorbitant amount of damages, which those attorneys present as being carefully calculated, but which are totally arbitrary.

Outside the courtroom, plaintiffs’ lawyers have recently adopted “lead generating” tactics that flood local airwaves with lawsuit advertising that touts extraordinary verdicts.

Its goal is to shape potential jurors’ opinions of appropriate compensation levels.

In recent years, plaintiffs’ attorneys have been encouraged and enabled to pursue those despicably manipulative tactics TPLF organizations.

The TPLF arrangement pays funders a return for investing to drive the cost of a lawsuit settlement as high as possible.

The higher the settlement award, the more money the plaintiff, their lawyers and the investors pocket.

Reptilian theory tactics and TPLF are driving the nuclear verdicts that are making it difficult or impossible for parties to negotiate a reasonable settlement.

Both have dramatically driven up insurance carrier costs, which in turn drives up the cost for insurance buyers.

A Perfect Storm

The combination of traditional crane insurance claims handling, plaintiff counsel’s reptilian theory tactics and TPLF has created a perfect storm for today’s crane insurance buyers.

We should admit that, for the most part, today’s crane insurance market is fundamentally broken.

Traditional insurers continuously attempt to cut their operating costs by discounting claims/legal handling expenses, one of their of their highest operating expenses.

That seems to represent prudent business management.

However, the plaintiffs’ attorneys know that those discounted legal and claim-handling resources are no match for them.

The highly skilled, highly motivated and now very-well-funded plaintiff lawyers are winning outrageously high settlements (nuclear verdicts) more often, so claim costs are skyrocketing, which in turn raises crane owner insurance premiums. It’s a vicious cycle, and the bad guys are winning.

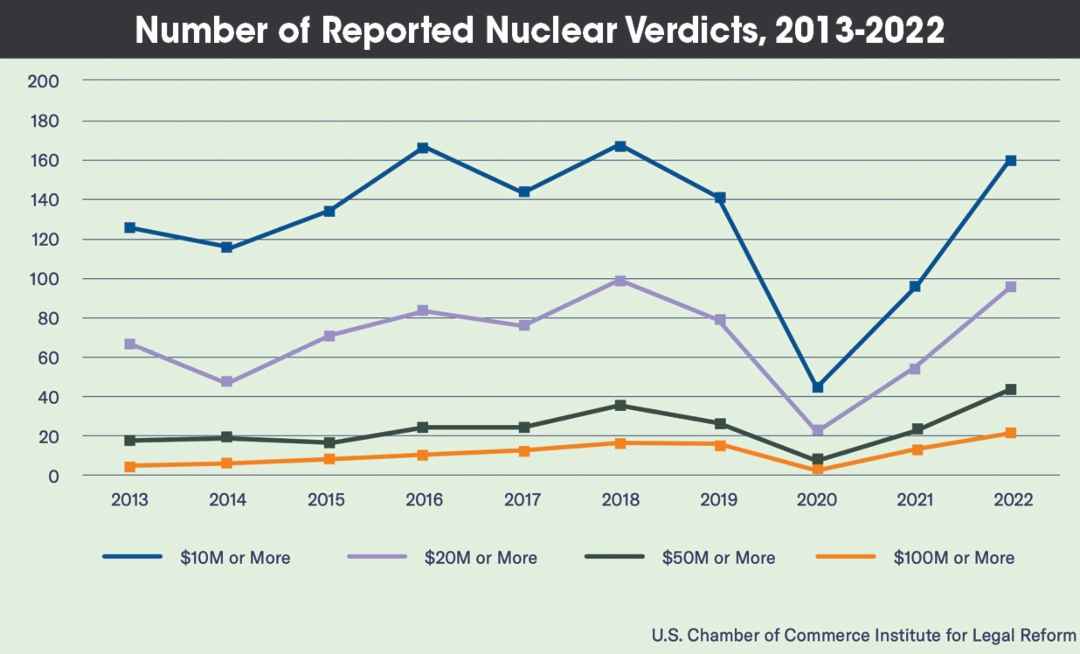

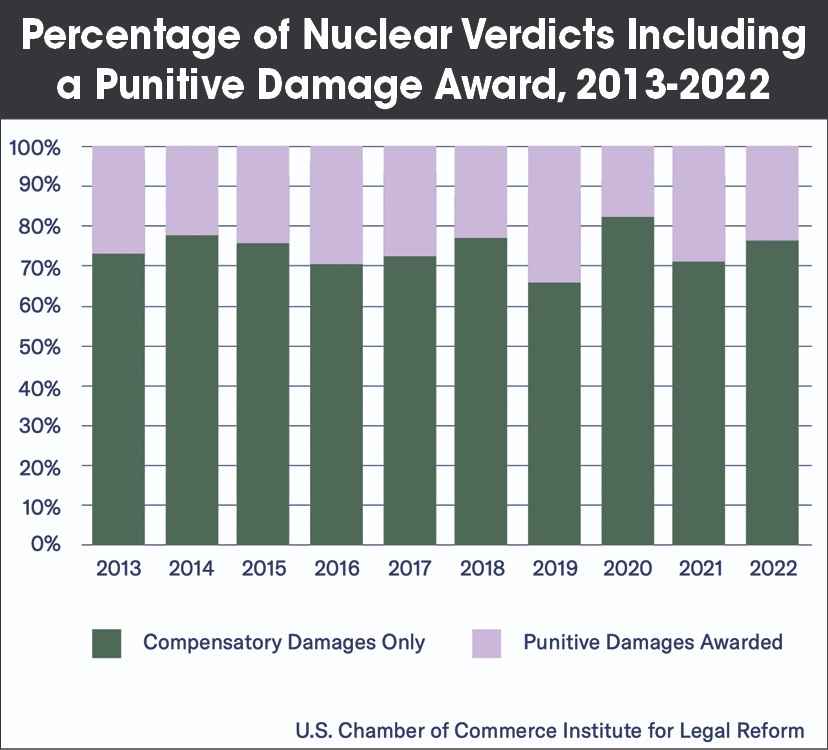

The value of accident verdicts has grown significantly both in frequency and size over the past 10 years:

The combination of reptilian-theory courtroom tactics with litigation funding by third-party investors directly affects crane owner insurance costs and limits insurance availability for crane owners.

To protect the viability of their businesses, crane owners must band together to drive collective risk mitigation solutions and to curb the exploitative plaintiffs’ lawyer tactics that contribute to nuclear verdicts and unaffordable insurance.

The Basics of Third-Party Litigation Funding

This litigation dynamic is driving crane insurance rate increases.

TPLF allows private equity managers and other financiers to invest in lawsuits in exchange for a percentage of any settlement or judgement.

This despicable practice started in Australia a few years ago and rapidly expanded to Europe, the U.S. and elsewhere. This litigation dynamic is driving insurance rate increases for crane owners and other high-hazard industries.

Without disclosure requirements and other commonsense safeguards, these funders are in process of taking over litigation that drives unmeritorious lawsuits.

This relatively new litigation dynamic is creating turbulence with insurance companies across the globe.

Litigation funders are actual financial entities that advance money to plaintiff law firms to cover litigation costs on a non-recourse basis contingent on the outcome of the case.

According to the Government Accountability Office, many are private finance institutions, some are publicly traded, some are hedge funds and many receive capital from various sources such as sovereign wealth funds, pension funds and endowments.

They are not actual parties to the lawsuits that they are investing in.

The Litigation Funding Agreement is a formal legal contract that sets the terms and conditions of the funding agreement.

Generally, these documents are not required to be disclosed.

Some courts and states are beginning to require disclosure either through a court rule or by legislation, for example The Federal District of New Jersey, Northern District of California (for class actions) and the Federal Districts of Delaware and Wisconsin.

The funding agreement is typically disclosed in one of two ways: only to the judge, or to the opposing party.

Disclosure allows the court and both parties to know the identity of the litigation funder, and that knowledge may help determine whether the funders are exercising undue influence that might violate ethical rules, or whether conflicts of interest exist.

Lastly, TPLF agreements typically say that if the lawsuit doesn’t garner any money for the plaintiff, the plaintiff’s lawyers don’t have to repay the litigation funder.

Conclusion and Real-World Implications

Recent increases in the frequency and amount of nuclear verdicts associated with TPLF lay bare problems with today’s civil justice system that are driving crane insurance rates in the wrong direction.

Those growing claim litigation factors adversely affect crane owner insurance programs and may make some crane owners uninsurable — which could put them out of business.

As an industry group, we can strengthen risk-management standards to discredit unreliable evidence that plaintiffs’ law firms use to generate nuclear verdicts.

We can band together to convince legislative powers to require that TPLF agreements be disclosed and to help stop misleading advertising by plaintiffs’ law firms.

Leading crane industry legal expert, attorney Robert C. Moore, has noted some risk management measures that have proven most effective against litigation.

“When Reptile Theory litigation was starting, some members of the Federation of Defense and Corporate Counsel (FDCC) made a concerted effort to stop plaintiff lawyers from asking witnesses questions meant to arouse jurors’ emotions so plaintiffs could argue that the defendant did not care about the plaintiff or society,” said Moore.

He added, “Step one is to manage claims with a robust and forceful defense carried out by skilled lawyers who can fight from the start.”

Step two, said Moore, is to lobby state and federal legislatures to pass laws that require plaintiffs to disclose third-party funding agreements and enable defense attorneys to cross examine plaintiffs about them.

The goal of this is to make sure juries know when witnesses might have a financial reason to embellish their testimony.

Step three, per Moore, is to offer unbundled insurance, which gives the insured company more control of whether to fight or settle each claim.

“We have seen the result of litigation gone amok. It’s verdicts in the hundreds of millions of dollars,” said Moore.

Our civil justice system is designed to resolve disputes fairly and uphold justice.

However, third-party litigation funders often operate with an agenda driven by profit, not principle.

Their willingness to influence and control litigation to maximize financial gain threatens to tip the scales of justice.

The recent cases involving our industry highlight a troubling pattern: funders operating in secrecy, with little accountability, and significant influence over legal outcomes.

This is not just a legal issue, it’s a matter of fairness and integrity.

That’s why it’s imperative for the crane industry to unite in calling for greater transparency and regulatory oversight of TPLF.

We must shine a light on this shadowy corner of the legal system and ensure that justice remains impartial and accessible — not a tool for profit-driven manipulation.

Kevin Cunningham has 27 years of experience in crane risk management and is president of Acies Crane Underwriters. He can be reached at kevin.cunningham@aciesmgu.com.