Looking Forward

Experts discuss the trends and drivers they foresee for 2026

As 2025 nears its end, the industry is trying to figure out what to expect next year.

The crystal ball is murky.

Changes in government priorities, material prices, interest rates, tariffs and supply chains can alter the landscape quickly.

To give readers a feel for what 2026 might look like, Crane Hot Line asked experts from different sectors of the industry to talk about trends they expect in the coming year.

Those experts are Macrina Wilkins of the Associated General Contractors of America (AGC), Brian Raff, vice president of government affairs and sustainability for the American Institute of Steel Construction (AISC), Michael T. Walsh, president and CEO of consulting engineer Dearborn Companies, Harry Fry, Jr., president of finance and leasing experts Harry Fry & Associates and a representative from the Association of Equipment Manufacturers (AEM).

Crane Hot Line thanks them all for sharing their insights.

Equipment Manufacturing

AEM is the major trade association supporting U.S. manufacturers of construction and agricultural equipment.

Here’s what its representative told us:

After a turbulent 2025, U.S. construction is entering 2026 with cautious optimism.

While total construction starts are projected to dip by 3.2%, the story behind the headline is more nuanced and encouraging.

Residential construction, which fell 7.7% last year, is showing renewed momentum.

Forecasts call for a 5.5% rebound driven by multifamily investment and expanded federal support for affordable housing.

Challenges remain. Mortgage rates are still elevated, and the nation’s housing deficit, estimated at 4.7 million units, continues to pressure affordability. Single-family starts are expected to rise 8.1%, with multifamily starts edging up 0.6%.

Nonresidential construction presents a mixed picture.

After a strong 2025 fueled by megaprojects, the sector is expected to contract 11.5% in 2026.

Manufacturing construction, which surged 38.1% last year, is forecast to fall more than 40% as major semiconductor and artificial intelligence (AI)-related facilities reach completion.

Data centers, however, remain a bright spot as technology companies continue to invest heavily in AI-driven infrastructure.

Civil engineering work is projected to remain stable, with growth of 0.1%.

Federal and state investments are keeping activity strong in transportation, especially in airports and bridges, which are expected to grow 14.7% and 4.8%, respectively.

Major undertakings such as the $11 billion SR400 Express Lane expansion and the $50 billion high-speed rail initiative highlight the sector’s continued focus on mobility and congestion relief.

Energy and utility construction is also gaining traction, projected to grow 3.4%.

While renewable energy faces some policy-related headwinds, investment in nuclear and traditional energy sources is accelerating.

The U.S. aims to quadruple its nuclear capacity to 400 GW by 2050, with Westinghouse planning to deliver 10 new reactors by 2030.

The ConstructConnect Project Stress Index (PSI) provides additional insight into preconstruction activity.

As of August 2025, the PSI measured 104.6, down 5.9% month-over-month, suggesting easing stress in the pipeline.

Bid delays and paused projects declined, and abandonment rates returned to more typical levels after a mid-year spike.

While private-sector indicators are stabilizing, rising public-sector abandonments point to growing fiscal pressure.

Bottom line: 2026 is shaping up as a transitional year.

Strategic investment, policy certainty and labor stabilization will be critical to sustained growth in the years ahead.

ConExpo-Con/Agg 2026, owned and produced by AEM, will showcase many of the innovations shaping those trends.

With more than 2,000 exhibitors and thousands of new products and technologies, the show is a key barometer of where the industry is headed, from smarter machines and emerging digital tools to solutions for workforce shortages, sustainability and productivity.

The technologies debuting at ConExpo-Con/Agg in March 2026 highlight opportunities for contractors of all sizes.

Steel Construction

The American Institute of Steel Construction (AISC) is a non-profit technical institute that partners with the architecture, engineering and construction community to develop safe, efficient steel specifications and codes while also driving innovation.

Brian Raff, AISC vice president of government affairs and sustainability, shares his perspective on 2026:

Analysts expect moderate growth in overall non-residential construction in 2026, although the projected growth rate is slightly slower than the 2025 forecast, according to Dodge Construction Network.

Dollar value: Total non-residential construction value is forecast to expand by 3% in 2026, to $481 billion, down slightly from the 4% forecast for 2025.

However, another projection suggests only 2% growth for the nonresidential total in 2026, following 2.6% growth in 2025.

Square footage: The building footprint is projected to expand by 3% in 2026, a significant improvement after an expected 2% decline in 2025. I think this is due to recovery in the commercial sector.

Growth in commercial construction should become more diversified in 2026, with retail, warehouse and hotel activity all expected to pick up.

This is contrary to 2025, when those sectors were the most vulnerable to a pullback.

This commercial recovery is strong enough to drive the total non-residential footprint into positive territory, even though manufacturing square footage is expected to decline by 7% in 2026.

Several economic and policy factors are poised to influence the industry in 2026.

Rate cuts and recovery: The anticipated recovery in smaller construction projects — including retail, warehouse and hotel sectors — will be supported by potential Federal Reserve rate cuts.

The Fed has already cut interest rates twice in 2025, most recently in October.

There’s a chance the Fed will cut rates again in December, which would certainly bolster real estate and construction loans.

Infrastructure certainty: The stability provided by the current law, the Infrastructure Investment and Jobs Act (IIJA), supports growth.

There is a push to pass the next multi-year transportation bill before the September 2026 deadline to assure long-term funding.

Decreasing input costs: Material costs have dropped significantly, and lead times for both purchased and fabricated steel are increasing more slowly. That may aid project delivery.

Here are some of the key challenges and headwinds we might face in 2026.

- Credit crunch: The biggest constraint on new lending for smaller commercial projects is a credit crunch.

- Many banks have tightened standards for commercial real estate loans for seven straight quarters, according to the Fed’s Senior Loan Officer Opinion Survey (SLOOS).

- Manufacturing pullback: The massive recent growth in the manufacturing sector is expected to reverse sharply in 2026, creating a significant drag on construction starts.

- Office market valuation crisis: Significant losses in the value of office properties are freezing all new lending for smaller commercial projects.

- Labor: Skilled labor shortages pose persistent challenges.

Here are some places growth is expected.

- Data centers: They are expected to see significant growth in 2026 and are a primary driver of the commercial sector.

- Institutional sector: Forecast to rebound strongly with 6% growth to $244 billion in 2026, following 1% growth in 2025.

- Commercial total: Growth is projected to accelerate to 7% (to a total of $195 billion) as the market diversifies.

- Hotels, retail and warehouses: Expected to begin recovery in 2026, contributing to commercial growth.

- Health and education: Health construction is projected to grow 3.8% and education 3.7%.

What sectors are expected to decline?

Manufacturing: Projected to see a significant pullback, with dollar value declining 24% to $42 billion as large projects conclude and trends normalize.

Traditional office construction: This sector faces continued headwinds due to evolving workplace trends.

Here are expected trends for 2026.

- Normalization of project size: The current market is heavily skewed toward mega projects (like data centers and manufacturing plants).

- High interest rates have slowed typical construction projects, including schools and retail.

- Expected rate cuts in 2026 are predicted to revive these smaller projects, narrowing the gap between small and mega construction.

- Power grid constrains data centers: A critical bottleneck is emerging in the largest growth market — data centers.

The primary constraint is the power grid, as utilities in key markets have told developers they cannot guarantee new power connections for the next three to five years.

The AIA/Deltek Architectural Billing Index is collapsing due to tight lending standards, which generally predicts slowing.

The most exciting aspects looking toward 2026 revolve around projected sector rebounds and the potential for a broader market recovery.

The projected 6% rebound in the institutional sector and the acceleration of growth to 7% in the commercial sector are highly positive indicators.

The expectation that potential Federal Reserve rate cuts will revive smaller projects signals a potential broadening of construction activity beyond megaprojects.

Data center construction is poised for even more expansion.

The progression of massive projects, such as the $10 billion Port Authority Bus Terminal replacement in New York (which requires over 100,000 tons of structural steel), highlights the continued execution of extremely large steel-intensive ventures.

The critical role and nature of current mega projects bear emphasis.

The current market relies heavily on a few massive projects. For example, year-to-date, the entire non-residential market is being held up by two sectors: manufacturing starts (up 82%) and data center starts (up 101%). These Goliath projects have the steel tonnage of dozens of smaller projects combined.

We must note that the Infrastructure Investment and Jobs Act (IIJA) expires on September 30, 2026.

While congressional staffers are already drafting the next multi-year bill, the industry should be focused on ensuring the new legislation provides long-term certainty for transportation funding.

General Contractors

The Associated General Contractors of America (AGC) serves some 27,000 member companies and represents all types of construction, except single-family homebuilding.

AGC senior research analyst Macrina Wilkins relates insights from recent research as well as her expectations for 2026:

Overall, the construction industry will navigate a challenging landscape in 2026.

However, the outlook, while mixed, is not altogether negative.

An AGC survey conducted at the start of the year found that contractors expected the strongest growth in data centers, water and sewer, power and transportation work.

Those categories have largely held up through 2025, and the outlook for 2026 still appears promising.

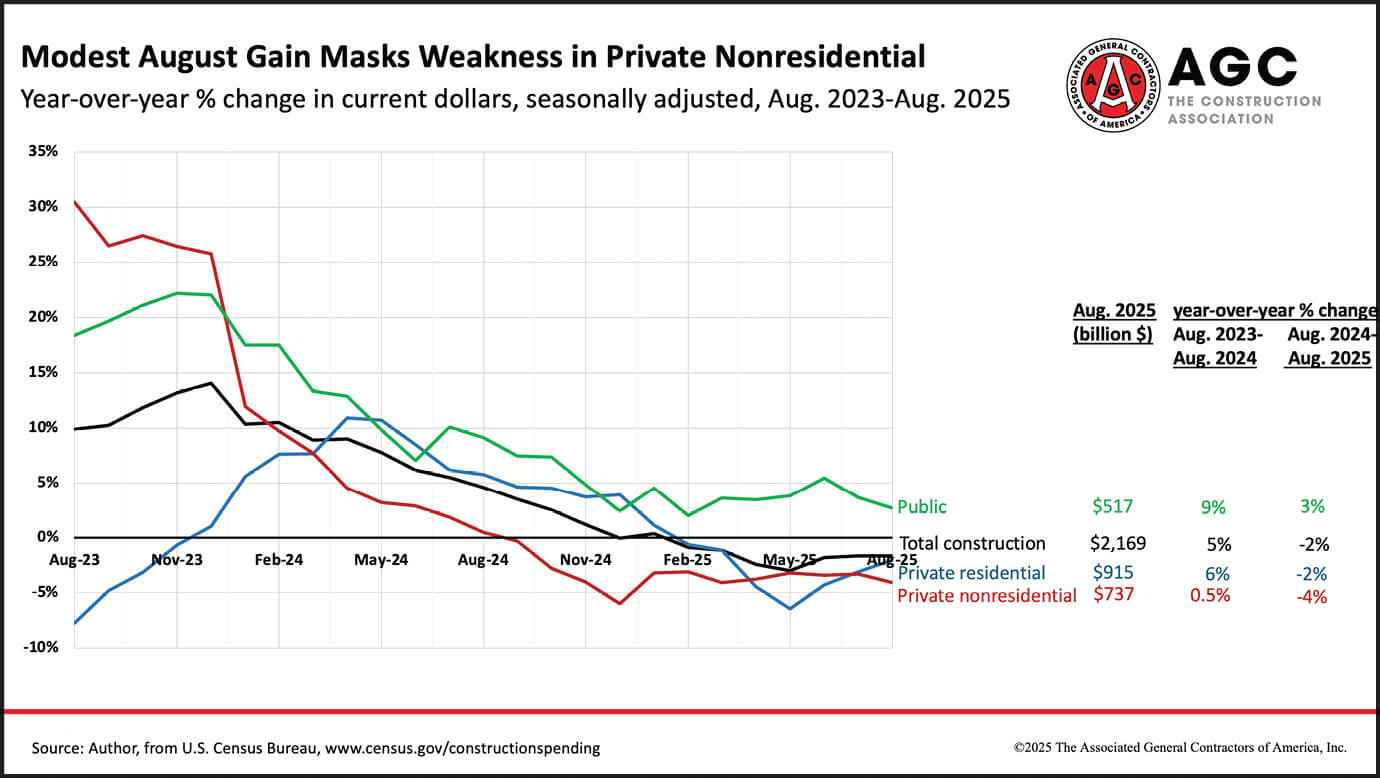

Private nonresidential has taken the greatest hit as the result of shifting monetary and foreign policy.

The uncertainty brought by unpredictable tariffs will continue to have more of an effect than their changes in material prices.

Aware that prices can change quickly, many firms are less likely to take on a project unless they are certain they have the people to take it on and that materials won’t be delayed.

Those two factors will loom large in 2026.

In a recent AGC workforce survey, data pointed to several factors behind project cancellations, delays or scope reductions.

Forty-three percent cited rising costs, 31% pointed to financing challenges, 26% noted shifts in demand tied to policy changes and 16% cited demand changes related to tariffs.”

Other challenges that will likely hold down growth in 2026 include a 5% to 6% rise in labor costs, a 2% to 4% rise in material costs and less available federal funds.

Nevertheless, the medium-term outlook for construction, as a whole, is slightly positive.

Data centers and power construction will lead the way; however, healthcare, pharmaceutical manufacturing and public infrastructure have the possibility to also grow.

Consulting Engineer

Dearborn Companies is a civil and structural engineering firm that serves a wide range of industries.

President Michael T. Walsh offers his views on 2026:

In terms of overall construction, my perspective seems to align with that of the mainstream construction industry economists for 2026.

On average, we’ll see low to moderate growth, with some markets exceedingly hot.

As construction engineers (means and methods experts) who serve asset owners and contractors, our perspective differs a bit from what pure design (plan and spec) engineers may perceive.

We focus on the heavy-lift and OW/OD transport arenas, and most of our work involves data centers, power generation and energy (oil and gas).

For us, all three of these market segments are hot at the moment and look to remain so.

The same eternal macro-economic factors will continue to affect us, with geopolitical stability being key.

Ongoing supply chain issues and shortages of skilled labor will continue to constrain our industry.

On the upside, trade deals are being inked, which brings stability to tariffs, helping normalize pricing for materials and equipment.

The trade deals provide much needed economic certainty.

While I’m not a fan of tariffs, they are generating one positive effect. Taken in concert with the tax relief and incentives of the One Big Beautiful Bill, they’ve started a drive among domestic and foreign corporations to reshore manufacturing here in the U.S.

I think this will launch in Q3-Q4 2026 and continue well beyond.

Then, of course, there is the AI data center “gold rush” and its colossal electrical power demand.

The beauty of this for the heavy lift / heavy transport industry is that all of it (data centers, generating stations, transmission and distribution systems) has very large, heavy and expensive things that require movement.

Life for the foreseeable future for those of us in this business should be quite good.

Data centers and the supporting energy infrastructure (electric generation, transmission and distribution) will be particularly active.

Nuclear powered generation seems to be enjoying a long-awaited renaissance.

I believe that new construction of commercial office towers will continue to be slow.

3D data capture, modeling and advancements in developing digital twins will continue to grow, as will growth in prefab and modular construction, robotics and autonomous equipment.

AI for construction applications is largely embryonic.

Much of what’s being touted presently as “AI” is really just task automation with a marketing wrapper.

Ask 10 people to define AI and you’ll get 10 different answers.

Development will take time.

The compounding expanse of opportunity, the scale of individual projects and the sheer number of them is mind bending.

There’s never been a better time to be in this business.

Equipment Financing

Harry Fry & Associates is a heavy-equipment finance company dedicated to the crane and lift industry.

Harry Fry, Jr., its founder and CEO, presents his insights about 2026:

Predicting economic, finance and leasing trends for any period of time is at best an educated guess but really comes down to a guess based on tangible and intangible observations.

However, based on the early results of Q4 2025, forecasting finance and leasing activity in 2026 may be different due to business news heard every day.

We constantly hear about the expansion of AI in many aspects of daily life and business.

The growth of AI calls for new or expanding data centers plus their massive energy requirements.

AI’s potential and its affiliated industries and services expected in 2026 and beyond have many believing this may be one of the greatest economic periods in our history.

The growth will be fueled primarily by capital expenditures from the private sector, which continues to raise enormous amounts of capital through the markets.

That activity will have a positive effect on the crane and lift industry for years to come.

When you add government trade deals, the door is now open for many foreign companies to build manufacturing plants in the U.S.

Those projects will require additional equipment.

The only cloud over the finance and leasing industry will be the availability of equipment.

The tariff issue is real, due to lack of clarity on the amount or percentage of the tariff.

Even though tariff issues are concerning, the demand for new or used equipment will continue to grow.

Once tariffs are clarified and new equipment starts flowing, along with projected Federal Reserve rate cuts between 50 and 100 basis points and favorable tax law changes taking effect, this all can only lead to one conclusion: equipment finance and lease industries should expect significant growth in 2026.

Like most years, the new year may start off a little slow, with lagging equipment deliveries restricting growth a bit in the first quarter.

But by mid year, finance and lease activity should be ramping up for a very positive year overall.