Where Cranes Will Stay Busy in 2026

Data centers, heavy civil and the states will be driving growth

If you’re planning fleet positioning for 2026, the signals are getting clearer: data centers, transportation infrastructure and select nonresidential building markets will continue to anchor crane utilization across the U.S.

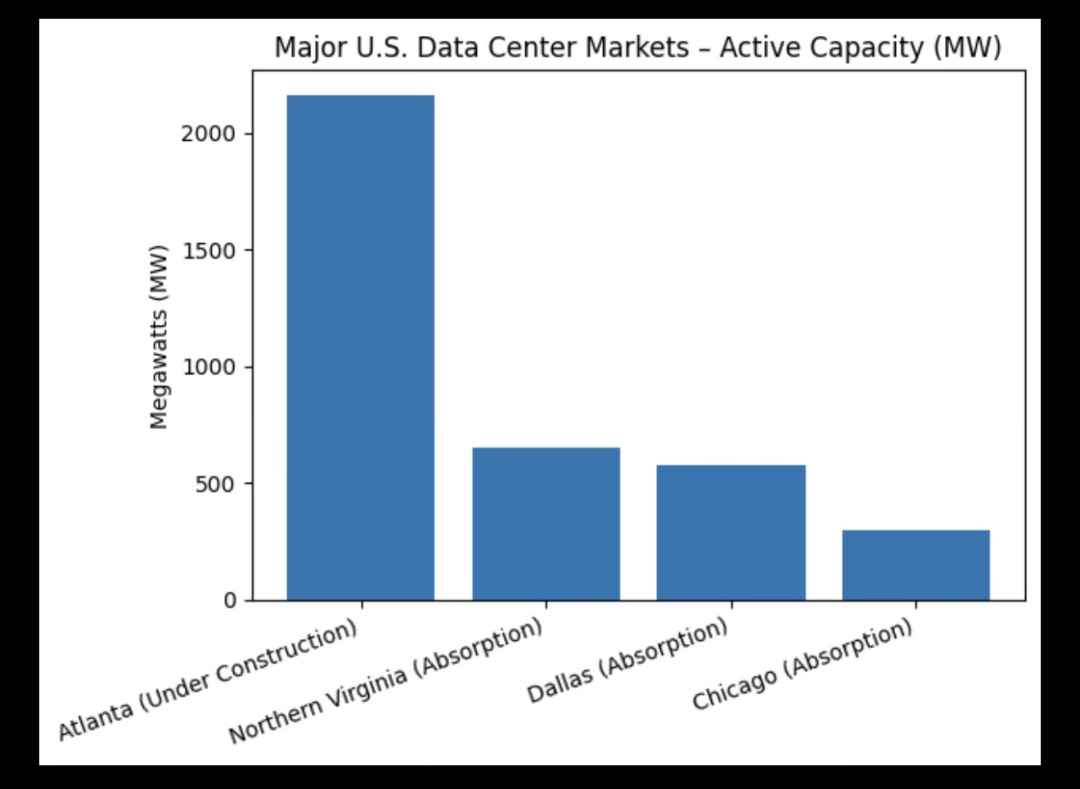

Data centers remain the most crane-intensive growth story. For crane owners and rental houses, this translates into sustained demand for crawlers and large all-terrains (ATs) for site development and steel, followed by mid-capacity rough-terrains for mechanical, electrical and repeat-build phases.

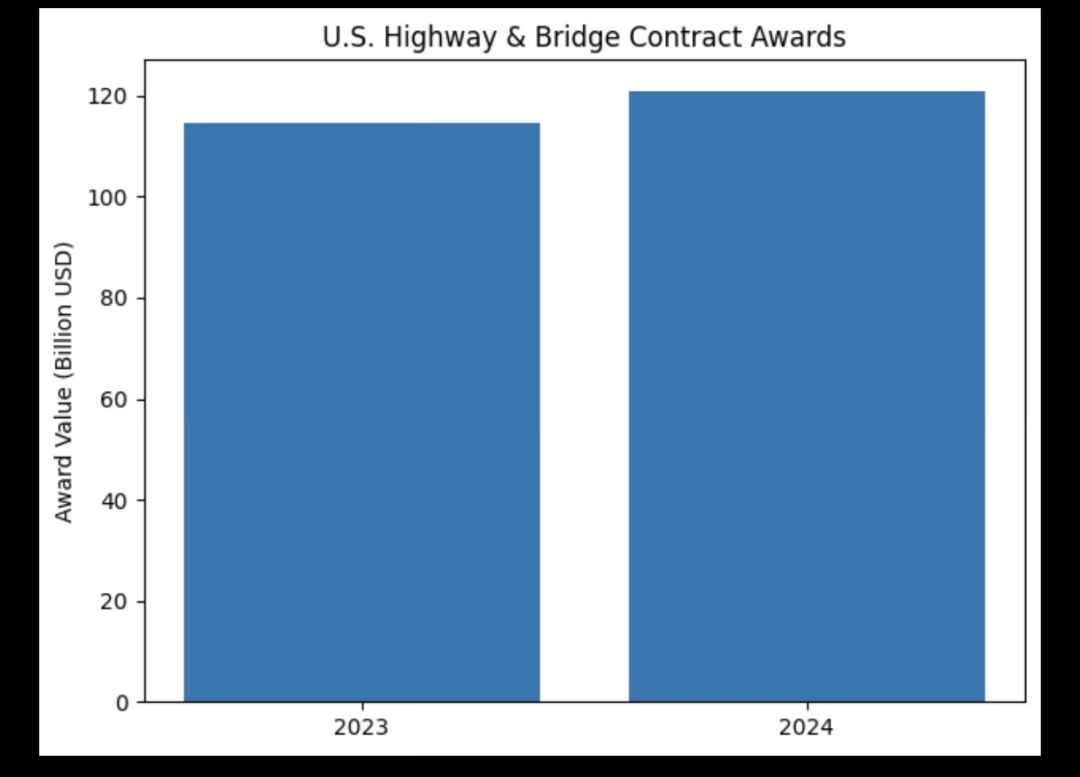

Heavy civil work is providing a foundation for ongoing utilization. These projects favor large crawlers, ATs and RTs, often tied up for extended durations — an important consideration for fleet availability and rental rate discipline.

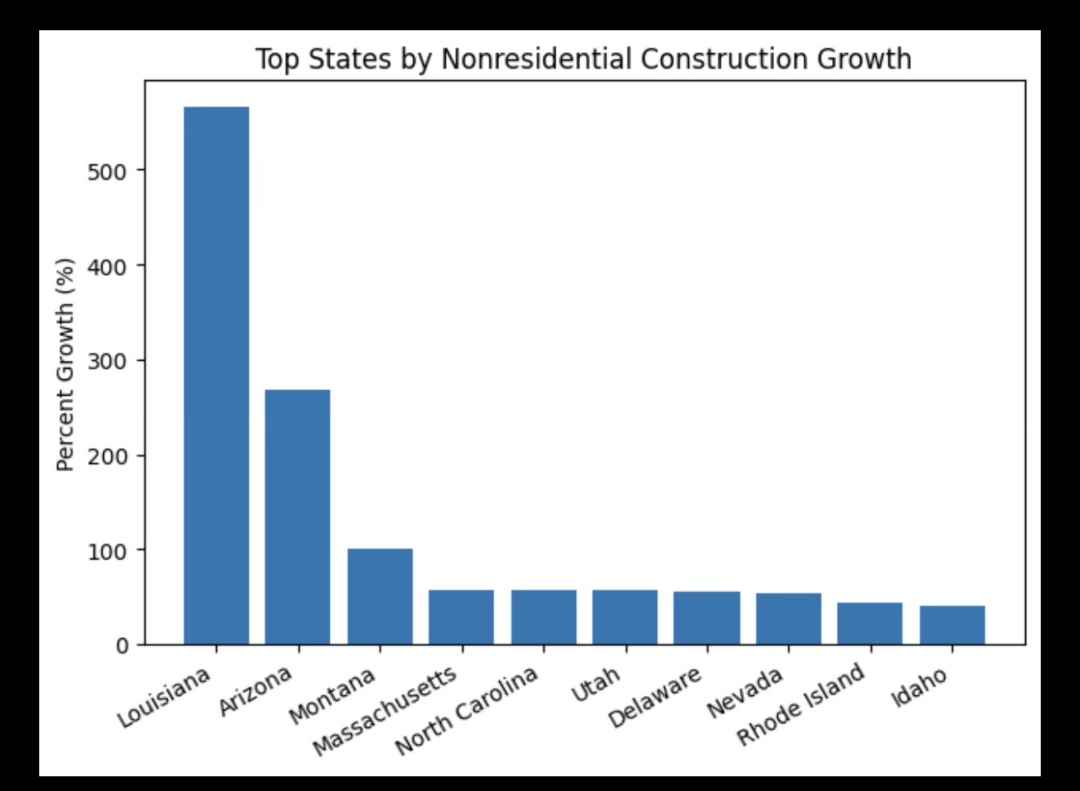

State-level nonresidential starts highlight where growth is accelerating the fastest. These spikes often coincide with large industrial, energy, institutional or civil packages — the types of jobs that quickly absorb crane capacity.

The challenge won’t be finding work — it will be having the right machines in the right markets at the right time. For example:

- According to CBRE, recording the largest total and a 195% year-over-year increase in the second half of 2024, Atlanta has moved firmly into the top tier of U.S. data center markets, placing the region in the top five nationally alongside Northern Virginia and Dallas.

- According to ARTBA, U.S. highway and bridge contract awards were at a record level in 2024. The largest markets by award value were Texas, California, Florida, New York and Illinois—states where major bridge, interchange and corridor projects translate into multi-year crane demand rather than short cycles.

- According to ConstructConnect, a comparison of nonresidential construction starts from January to September 2025 vs the previous year shows the fastest percentage growth concentrated in a mix of Gulf Coast, Mountain West and Northeast states.

What this means for crane utilization is that demand in 2026 will be strongest where three forces overlap:

- Data center clusters with overlapping build schedules

- Transportation awards converting into active construction

- Nonresidential starts accelerating at the state level

For fleets, that means planning for long-duration crawler commitments, high utilization of 300 to 600-ton ATs and steady demand for RTs and taxi cranes supporting mechanical, electrical and finishing scopes of work. And while markets tied to data centers and infrastructure are less cyclical — and more predictable — than discretionary commercial work, across the board cranes will stay busy in 2026.