The Business of Suing

Plaintiffs’ hidden investors drive up crane owners’ litigation costs

Editor’s Note: This is the second of three articles by insurance industry expert Kevin Cunningham that address the malady of rapidly rising insurance costs in the crane and heavy-haul industries. The first article appeared in the September 2025 edition of Crane Hot Line; Look for the third article in the November edition.

As the follow-up to “Crane Insurance Market Conditions” (Crane Hot Line, September 2025, pages 32-34), this article further discloses litigation factors that are hurting today’s crane insurance buyers.

One of those factors is firms that make a business of secretly funding accident litigation.

Another is a dramatic increase in plaintiff-lawyer advertising that raises clients’ hopes of absurdly huge monetary settlements.

Both of those factors are making crane insurance more expensive, and in some cases unaffordable, for crane owners.

National research from the American Tort Reform Association (ATRA) shows that 2024 saw plaintiff legal service providers spend more money on television, radio and outdoor advertising than ever before. Here are three telling statistics.

- The number of TV ads has increased by more than 44% since 2017

- Radio ads surged to over 6.8 million in 2024 – up 217% from 2017

- Outdoor advertising, including billboards, rose by over 260% since 2017.

Dark Money Driving

Those dramatically rising numbers of ads can be attributed to third-party litigation funding (TPLF), which is driving legal system abuse, driving up insurance claims and delaying standard settlements.

TPLF enables plaintiff attorneys to over-promise potential clients big paydays, which creates unrealistic expectations.

Those inflated expectations can make it hard for insurers to negotiate a reasonable out-of-court settlement, and it can also prolong the time it takes to settle, which influences the way jurors process facts.

According to ATRA, if an insurer takes a long time to settle a claim, jurors often see the insurance company as unsympathetic or stingy, even if the plaintiff’s lawyers are asking for unreasonable or exorbitant compensation.

If jurors see the insurance company as being unreasonable, they are more likely to award the plaintiff higher punitive damages.

TPLF, also known as “Dark Money,” comes when investors finance lawsuits in exchange for a portion of the settlement.

According to the Insurance Information Institute’s September 2025 briefing report, TPLF, or Dark Money, is a major force driving the surge of massive litigation settlements in recent court cases.

Lawyers have an ethical obligation to exercise independent judgment and zealously represent their clients’ interests.

A TPLF investor, on the other hand, is purely a profit-seeker gambling on a “Dark Money opportunity,” without any ethical or professional interest in justice or the personal circumstances of the plaintiff.

Hidden Influence Prolongs Litigation

By enabling broader sustained legal action, TPLF may amplify systematic challenges in how insurers model risk factors.

When backed by TPLF’s deep pockets, plaintiffs’ lawyers are less prone to agree to reasonable settlements. They’re more likely to hold out, hoping that jurors will award the huge payday of a nuclear verdict.

As that happens more often, insurers must raise their premiums and deductibles to cover expected expenses and losses. In the end, both the insurance company and its clients — crane owners — suffer.

According to a U.S. General Accounting Office 2024 report, “Third party funders complicate settlement negotiations, contributing to longer settlement times and longer settlement negotiations measurably increase the cost to settle.”

In this regard alone, TPLF is fundamentally changing the civil justice system.

This article strongly advocates that courts and legislators require disclosure of litigation financing agreements and adopt reforms to negate plaintiff counsel tactics to lengthen litigation from standard timelines.

TPLF is fundamentally reshaping every aspect of the litigation process — which cases get brought, how long they are pursued and when they are settled.

And all of this is happening without transparency.

That means the judiciary is being quietly transformed.

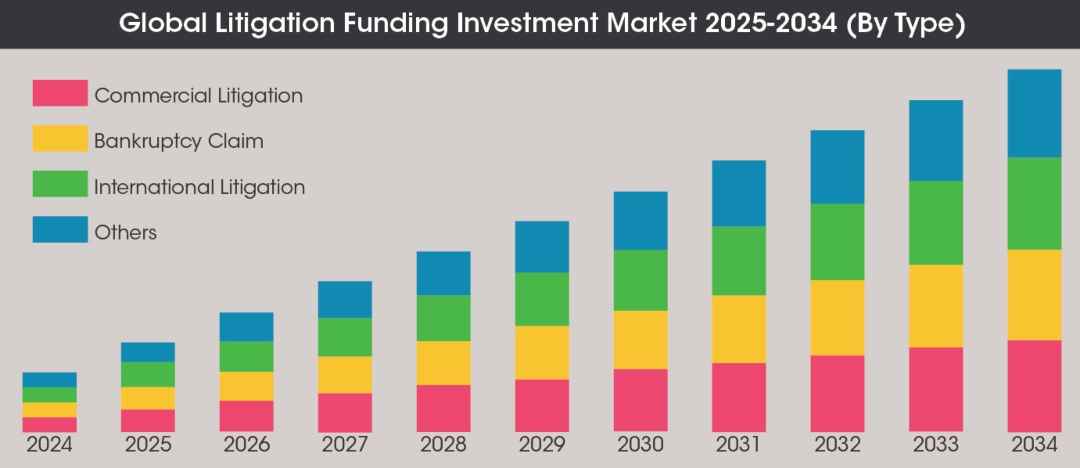

- What started as $5 million to $10 million investments in a single commercial case has grown into litigation funding loans exceeding $100 million to law firms for their entire caseloads.

- According to Bloomberg Law Group, “It’s a built-in diversified portfolio that hedges risk.”

- In the Cornell Journal of Law and Public Policy, Professor Donald Cochran noted that “TPLF turns the American justice system into a financial playground by transforming lawsuits into investment vehicles.”

- Presently, in most states, TPLF arrangements are rarely disclosed — and, therefore, remain largely hidden from scrutiny. Parties may seek disclosure of litigation funding arrangements through discovery, but opponents routinely object based on relevance or privilege. It appears that as of now litigation funding can only be disclosed to jurors if there is actual evidence and definitive reason the funding arrangement is relevant to the underlying facts, claims and defenses of the case.

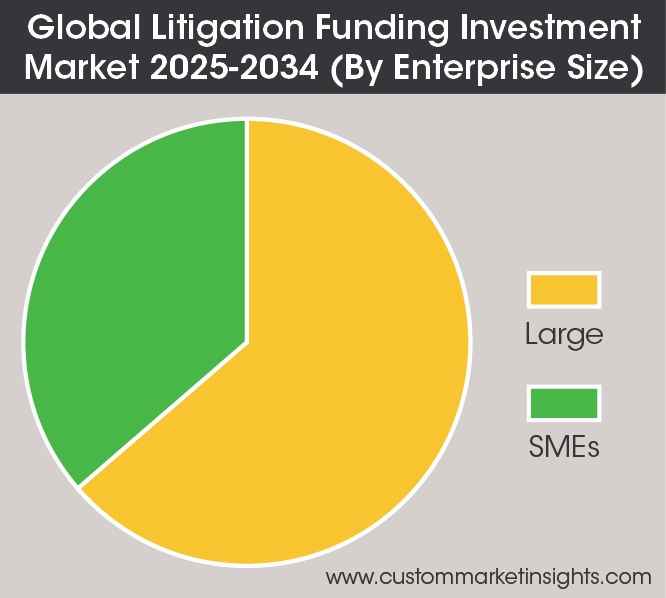

Experts expect global litigation funding to keep rising for at least the next nine years.

Crane Industry Stakeholders Must Band Together

To help keep TPLF arrangements and attorney advertising from totally reshaping the legal landscape, crane and heavy-haul companies, their insurers and other industry stakeholders must band together to balance access to justice by preserving the integrity of the legal system.

Without stronger advocacy by industry trade groups, the impact of tort advertising and TPLF will likely put more strain on insurers, possibly erode public trust in our civil justice system and certainly cost crane owners more.

If we can form a crane industry coalition to encourage best safety practices and to require that jurors see the often-hidden influence of Dark Money, we can create a fighting chance to both reduce accidents and to shine a light on legal system abuse by TPLF.

Call for Transparency

Private-equity-type investors are pouring billions of dollars into large-scale TPLF in an effort to turn the courts into investment opportunities.

Crane owners and related companies can create our own collective effort to counter that despicable practice.

We can create an industry-wide coalition calling for full disclosure of the billions of dollars that TPLF is investing.

Conclusion

According to the Council of Insurance Agents & Brokers (CIAB), “TPLF is contributing significantly to reduced availability and increased pricing in key liability insurance lines.”

The CIAB’s first-quarter Commercial Property/Casualty Market Report for 2025 notes that the TPLF practice is affecting claims trends and insurer underwriting behavior across umbrella, automobile and general liability insurance. “When coverage is available, premium costs have risen measurably,” it said.

In Crane Hot Line’s November edition, the third article in this series will focus on practical solutions to TPLF through alternative risk financing methods and industry safety alliance initiatives.

Kevin Cunningham has 27 years of experience in crane risk management and is president of Acies Crane Underwriters. He can be reached at kevin.cunningham@aciesmgu.com.