VMAC released its 2025 State of the Mobile Compressed Air Industry Report, based on original research from professionals across equipment repair, construction, infrastructure, agriculture and resource sectors, including mining, oil and gas and forestry.

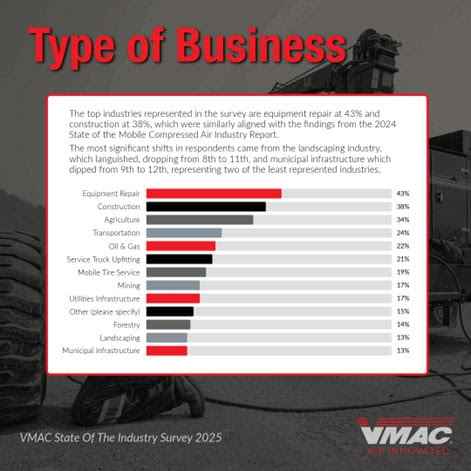

According to the report, equipment repair (43%) and construction (38%) remain the most represented industries, while landscaping and municipal infrastructure no longer appear in the top ten. Fleet trends show that 77% of service vehicles are under ten years old — up ten points from 2024 — and 74% of companies operate just one to five trucks.

Compressed air tools continue to dominate the jobsite. The majority of operators use impact wrenches (83%) and drills (81%), and only 5% report using no air tools. Rotary screw compressors remain the preferred style, valued for performance, size, and weight. Gas-engine above-deck compressors were favored slightly over UNDERHOOD systems, with 36% versus 32% usage.

Most users — more than 79% — require less than 100 CFM for their service-vehicle tools, even in demanding sectors like construction. The report also highlights growing hesitation around electric vehicles. Respondents cited limited range (67%), lack of charging infrastructure (59%) and long charge times (55%) as top barriers.

Business challenges identified include difficulty finding and retaining skilled labor (58%), tariffs on imports (49%) and economic slowdown concerns (48%). Despite these pressures, more than 80% of respondents expect business conditions to either improve or stay the same in the coming year.

According to VMAC, the insights gathered from industry professionals help create actionable data that can support business success in today’s evolving work environment.